B.Com with ICAI

The B.Com. with CA Prep (ICAI) program at Doon Business School is a rigorous dual-focus degree engineered for students committed to achieving the Chartered Accountancy (CA) credential.

This program strategically integrates the formal B.Com. academic curriculum with dedicated, parallel coaching for the ICAI examinations (Foundation, Intermediate, and Final stages). This collaboration ensures that theory not only meets but directly supports practical application and professional certification.

Key Program Advantages

ICAI Alignment

The curriculum is meticulously structured to cover the ICAI syllabus requirements, providing a high-standard foundation in Advanced Accounting, Auditing, Corporate Law, Taxation, and Financial Management.

Expert Faculty

Learning is facilitated by seasoned Chartered Accountants and industry expert guest faculty, ensuring deep insights into real-world professional challenges and the specific demands of the CA exams.

Skill Development

Beyond the statutory requirements, the program develops advanced critical thinking, complex problem-solving, and ethical decision-making, core competencies essential for success in the dynamic finance and auditing landscape.

Professional Pathway

This approach provides a strategic advantage and accelerated pathway, enabling students to achieve a recognised professional qualification (CA) efficiently alongside their formal degree, fostering the next generation of highly qualified accounting professionals.

Career Opportunities

- Chartered Accountant (CA)

- Tax Consultant

- Financial Analyst

- Management Accountant

- Forensic Accountant

- Financial Planner

- Corporate Finance

- Financial Controller

- Financial Consultancy

- Business Advisory Services

- Insurance and Risk Management Consultant

- Eligibility Criteria

- Course Structure

- Fee Structure

- Scholarship

- USPs of the Program

- Other Specialization

Eligibility Criteria

To pursue this program student must have

- Min. 60% in Graduation with appereance in National Level Entrance Examinaiton + Online Interview + Writing Test ( Merit on the basis of cumulative Score on the basis of X+XII + Online Interview + Writing Test )

Course Structure

| SEMESTER I | SEMESTER II | ||

|---|---|---|---|

| Subject | Credits | Subject | Credits |

| Principles and Practice of Accounting* | 3 | Cost Accounting** | 3 |

| Business Law* | 3 | Business Correspondence and Reporting | 3 |

| Fundamentals of Financial Management** | 3 | Banking & Insurance | 3 |

| Business Economics* | 3 | Logical Reasoning and Statistics* | 3 |

| Business and Commercial Knowledge* | 3 | Corporate Writing | 3 |

| Financial Literacy using Digital Platform | 2 | MS Office Skill | 2 |

| Digital and Technological Solutions (Tally) | 2 | Health & Wellness Yoga | 2 |

| Business Mathematics – I* | 3 | Business Mathematics-II* | 3 |

| TOTAL | 22 | TOTAL | 22 |

| SEMESTER III | SEMESTER IV | ||

| Subject | Credits | Subject | Credits |

| Financial Reporting | 3 | Management Accounting** | 3 |

| Taxation-I | 3 | Investment Banking | 3 |

| Strategic Management** | 3 | Financial Institutions, Markets & Services | 3 |

| Corporate and Commercial Laws | 3 | Income Tax Laws – I ** | 3 |

| Fundamentals of Financial Technology | 3 | Advanced Accounting -I ** | 3 |

| Project on Community Service | 3 | Capital Market Exposure/ Foreign Language | 3 |

| Leadership & Personality Development/ Aptitude Skills | 3 | ||

| TOTAL | 21 | TOTAL | 18 |

| SEMESTER V | SEMESTER VI | ||

| Subject | Credits | Subject | Credits |

| Income Tax Laws-II ** | 3 | Security Analysis and Portfolio Management | 3 |

| Advanced Accounting – II ** | 3 | Ethics in Auditing ** | 3 |

| Auditing and Assurance ** | 3 | Operations Research | 3 |

| Goods and Services Tax ** | 3 | Wealth Management | 3 |

| Electives -1 | 3 | Electives -2 | 3 |

| Summer Internship | 4 | Electives -3 | 3 |

| TOTAL | 19 | TOTAL | 18 |

* Courses for CA Foundation, ** Courses for CA Inter

Apart from classroom teaching intensive coaching will also be required through a third-party CA Prep organisation

Fee Structure

B.Com with [CA Prep. (in line with ICAI) | ACCA-UK | CPA-US] Examination Cost is additional 2026 - 29

| Fees | I Semester | II Semester | III Semester | IV Semester | V Semester | VI Semester |

|---|---|---|---|---|---|---|

| Admission Fee | 15,000 | - | - | - | - | - |

| Tuition Fee | 90,000 | 90,000 | 96,000 | 96,000 | 1,02,500 | 1,02,500 |

| University Examinations Fees | 5,500 | 5,500 | 5,500 | 5,500 | 5,500 | 5,500 |

| Total | 1,10,500 | 95,500 | 1,01,500 | 1,01,500 | 1,08,000 | 1,08,000 |

| Security (Refundable) | - | - | 10,000 | - | - | - |

| Other Incidental Compulsory Charges | ||||||

| Charges for Uniform (Dress Camp) | 9,500 | - | - | - | - | - |

| Book Bank (EET Library) | 4,500 | - | - | - | - | - |

| Career Development Cell Membership | - | - | - | - | 7,500 | - |

| Alumni Registration + 1 Year Enrollment | - | - | - | - | - | 5,000 |

| Online ERP Fee | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 |

The classes in the University may stretch till late evening and require many group projects and hence students are advised to stay in the campus hostels.

However, day boarding (Rs.25,000/ year) is compulsory for MBA, BBA, Integrated MBA, B.Tech, Integrated B.Tech, B.Com & Integrated Law programs other than the final year.

*Scholarship amount (if any) will be calculated on B.Com tuition fee for first year Rs. 90,000 per semester and subsequently thereafter.

Fee is subject to change. For updated fee structure kindly visit www.doonbusinessschool.com / www.dgu.ac

All under graduate degrees can be converted into the respective Hons. program through following pathways Research/Industry Attachment/Start-Up/Super Specialised Courses.

Scholarship

For Undergraduate Students for 2025-26 intake

| CATEGORY | All India | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| SCHOLARSHIPS | 10.00% | 20.00% | 30.00% | 40.00% | 50.00% | 60.00% | 70.00% | 80.00% | 90.00% |

| 12th Percentage (Any Central Board) | 80.00-84.99 | 85.00-89.99 | 90.00-92.50 | 92.60-94.99 | 95 | 96 | 97 | 98 | 99 |

| JEE Percentile | 75-79.99 | 80 - 84.99 | 85 - 89.99 | 90 - 94.99 | 95-95.99 | 96-96.99 | 97-97.99 | 98-98.99 | 99-100 |

| CUET Percentile | 88 - 89.99 | 90-91.99 | 92-93.99 | 94-94.99 | 95-95.99 | 96-96.99 | 97-99.99 | 98-98.99 | 99-100 |

Note: Best 4 Core Subjects only (SUPW, Physical Education and Non Academic Subjects will not be considered)

Satya Devi Special Scholarship for Bihar Students

(BSCC Eligible)

Get a one-time non-returnable grant of Rs.2.5 Lakh Or 25% Scholarship on tuition fees whichever is lower

For B.Sc. Agriculture/ Forestry / Agri Business

(Dr. S. K. Gupta Memorial Scholarship)

25% Scholarship on tuition fees

Scholarship for Uttarakhand Domicile

25% on Tuition Fee

Scholarship for Single Mother (All India)

10% on Tuition Fee

Scholarship for Teacher Ward (All India)

10% on Tuition Fee

Scholarship for Defence Personal Ward (All India)

10% on Tuition Fee

Note: No two scholarships can be clubbed together, if any student eligible for two scholarships may choose the higher scholarship from the respective category.

Procedure

- Students registering for scholarship should apply on the prescribed form avaliable with the institute or on website at the time of interview before confirmation of admission. Students who do not apply before confirmation of admission wlil not be eligible for merit scholarship.

- Students should submit photocopies of all mark sheets and certificates required as above for entitling the scholarship.

- Upon your official confirmation of admission with the DBSG, you wlil receive a formal scholarship offer letter / confirmation.

- The scholarship wlil be disbursed semester wise.

- In case the result of the previous semester has not been declared tlil the last date of submission of fees for the next semester, the student may provisionally submit fees equivalent to the last semester fees but in case falis to get the required marks wlil have to submit the balance fees.

- Whlie applying for a scholarship and fliling in the percentage of class XII marks, applicants are required to consider the aggregate of Best 4 core subjects in their XII boards (SUPW, Physical Education and Non Academic Subjects wlil not be considered).

- Scholarship amount will be calculated on General (basic) tuition fee for per semester and subsequently thereafter.

However the scholarship for 3rd semester onwards wlil be subject to:

In case any of the above criteria is not fulfliled the scholarship for the next semester wlil be withdrawn.

- 75% attendance to be maintained in each subject individually in the preceding semester. Please note that Third Semester Scholarship depends on First semester performance and Fourth semester Scholarship on second semester.

- 70% marks in cumulative score in all subjects.

- Students shall not be involved in any disciplinary action of misconduct where a penalty or fine is imposed by the Proctorial board.

- Students shall take a good moral character certificate from the course coordinator every year and submit the same with the Registrar.

- Students should give an undertaking of being avaliable at all time during the course for any brand ambassador activities and also in case of events/goodwlil programmes.

- There should be no discontinuation in study. In case of transfer to any other institute, the scholarship given wlil have to be refunded prior to issue of College Leaving Certificate.

- Students need to send a thank you letter to the Board of Trustees for the Generous Scholarship every semester.

Disclaimer

-

Notwithstanding anything under this Scholarship scheme, ESKAY EDUCATIONAL TRUST has sole discretion to edit, modify, change, update, continue or abandon the above-mentioned Scholarship going forward at any given point in time, without any prior written intimation. Management wlil be the final deciding authority for all scholarship decisions as stated in this specific disclaimer.

-

There is no concept of automatic renewal for next semester. The Sponsorship Committee shall decide every semester on a case-to-case basis, subject to the Scholarship Scheme if prevaliing at the relevant time.

-

There should be no discontinuation in study. In case of discontinuation / transfer to any other institute, the scholarship given wlil have to be refunded prior to issue of college leaving certificate.

-

Please note that this communication is without prejudice to any rights of ESKAY EDUCATIONAL TRUST and this communication should not be considered as a waiver of any rights of ESKAY EDUCATIONAL TRUST in the applicants' favour.

USPs of the Program

Seamless CA Integration

Integrate Chartered Accountancy (CA) preparation seamlessly into your B.Com, ensuring a comprehensive education that aligns with the rigorous standards set by the Institute of Chartered Accountants of India (ICAI).

Industry-Endorsed Certification

Elevate your credentials by acquiring a CA qualification from ICAI in the shortest possible time, positioning you as a finance professional prepared for the complexities of accounting, taxation, and financial management.

Practical Application Emphasis

Embrace hands-on learning with a curriculum designed for real-world challenges. The program focuses on practical applications, bridging the gap between theory and the dynamic demands of the accountancy field.

Expert Faculty Guidance

Benefit from industry-expert faculty who provide mentorship and guidance, ensuring you receive insights from seasoned professionals and are well-prepared for the challenging CA examinations.

Holistic Skill Development

Beyond exam preparation, the program fosters holistic skill development, nurturing critical thinking, problem-solving, and industry-relevant skills essential for success in diverse financial domains.

Other Specialization

Placements

Enjoy Everyday while Ensuring Great Career

Thanks to DGU’s mock interviews, value‑added courses, and hands‑on projects I developed confidence, communication skills and real-world business sense. The practical exposure and industry-aligned learning helped me step into Indigo Paints Limited ready to perform and grow.

From engaging campus activities to hands-on projects, DGU made learning practical and exciting. This experience helped me step into Reliance Retail ready to make an impact.

One thing that really helped me during the placement season was the confidence I gained from the mock sessions. My professors pointed out mistakes I hadn’t even realized I was making and gave me valuable tips that made the process smoother. This foundation prepared me well for my role at Asian Paints Ltd.

The mix of interactive learning, practical projects, and expert guidance shaped my skills effectively. It gave me the confidence to start my professional journey with Tech Mahindra.

Hands-on learning, value-added courses, and supportive faculty prepared me for real-world challenges. These experiences helped me confidently join Hafele India Pvt Ltd and contribute from day one.

DBS Global University’s rigorous learning environment and hands-on experiences challenged me to grow constantly. This preparation gave me the confidence and skills to step into Grant Thornton Bharat LLP with readiness.

DBS Global University’s competitive and dynamic environment pushed me to perform at my best every day. This energy, combined with practical learning and guidance from faculty, helped me secure my role at MyGetWellStore.

DBS Global University’s practical projects and faculty guidance helped me build real-world skills and confidence. This preparation enabled me to step into Prism Johnson ready to contribute effectively.

At DBS Global University, engaging in practical projects and hands-on learning enhanced my skills and confidence, equipping me to step into my role at Phronesis Partners with clear direction and focus.

Through DBS Global University’s hands-on projects and skill-focused sessions, I gained practical experience and strengthened my confidence. These opportunities equipped me to make meaningful contributions at Digital Marveled Private Limited.

DGU helped me grow into someone who can take on challenges with confidence and clarity. My placement at Extramarks Education feels like the right step toward building a meaningful career.

DGU shaped my skills through constant guidance, practical exposure, and a supportive environment. Getting placed at High Beam Global feels like a strong beginning to my professional journey.

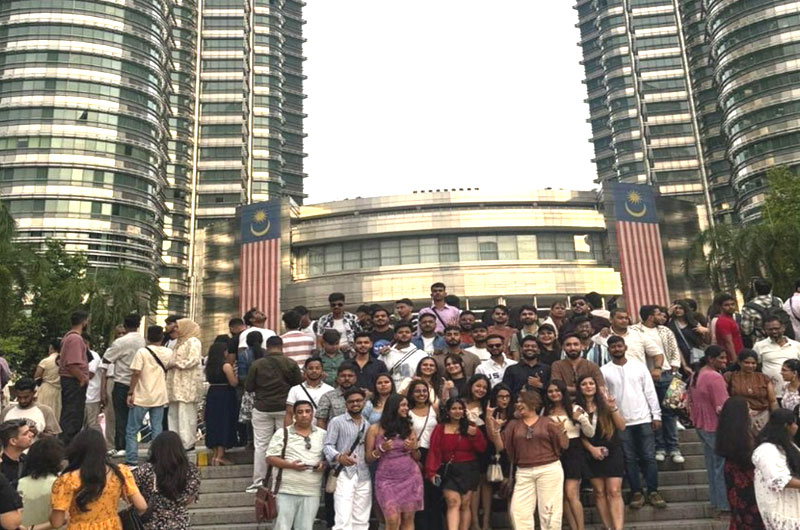

Student Education Immersion Program

Study Abroad Opportunities for Global Careers

DBS Global University offers students flexible and impactful study abroad pathways designed to build global competence and career readiness. Backed by a strong network of 50+ MOUs across 20+ countries, the University enables meaningful international exposure through Short-Term Global Immersion Programs, Credit Transfer Study Abroad Programs, and Dual Degree & Long-Term Global Pathways.

Through strategic partnerships with institutions across Australia, USA, Europe, Malaysia, Singapore, Dubai, Thailand, Indonesia, Turkey, Hong Kong and Russia, students benefit from internationally benchmarked curricula, industry exposure, multicultural classrooms, and cross-cultural learning. These experiences integrate academics with experiential learning, global networking, and real-world insights—empowering students with a global mindset, enhanced employability, and the skills required for successful international careers.