Derivatives

Derivatives are financial instruments whose value is derived from the value of an underlying asset, index, or rate.

They are contracts between two parties, known as the buyer and the seller, where the value of the derivative is based on the future movements of the underlying asset.

Derivatives are widely used for hedging, speculation, and managing risk in financial markets. There are several types of derivatives, with the most common ones being futures contracts, options, and swaps.

Advantage @DGU

- Dehradun - A Safe, Beautiful & Cosmopolitan Education City.

- Bundle of Industry Integrated Value Added Certificates.

- Students from 23 States & 5 Countries on campus.

- Multiple Placements for all.

- More than 350+ Companies for Campus Placement.

- Possibilities of International Exposure.

- Separate in campus Girls & Boys hostels with Modern Sporting & Gym facilities.

Level & Duration

Level

Certificate

Duration

1 Year

Key aspects of the Program

Futures Contracts

Futures contracts obligate the buyer to purchase, or the seller to sell, a specific quantity of an underlying asset at a predetermined price on a specified future date. These contracts are standardized and traded on organized exchanges. Futures contracts are commonly used for hedging against price fluctuations in commodities, currencies, and financial instruments.

Options

Options provide the buyer with the right (but not the obligation) to buy (call option) or sell (put option) an underlying asset at a predetermined price within a specified time frame. The buyer pays a premium for this right. Options are used for speculation, hedging, and risk management. There are two types of options: call options and put options.

Swaps

Swaps are agreements between two parties to exchange cash flows or other financial instruments over a specified period. Common types of swaps include interest rate swaps, currency swaps, and commodity swaps. Swaps are often used to manage interest rate risk, currency risk, or to optimize cash flow.

Forwards

Forwards are similar to futures contracts but are typically traded over-the-counter (OTC) rather than on organized exchanges. A forward contract is an agreement between two parties to buy or sell an asset at a specified future date for a price agreed upon today. Unlike futures contracts, forwards are customizable and may not be as standardized.

Interest Rate Derivatives

These derivatives are based on interest rates and include instruments like interest rate swaps, forward rate agreements (FRAs), and interest rate futures. They are used for managing interest rate risk in various financial transactions.

Commodity Derivatives

Derivatives related to commodities include futures and options contracts based on the prices of commodities such as gold, oil, agricultural products, and more. They are used by producers, consumers, and investors to manage price volatility.

Currency Derivatives

Currency derivatives, such as currency futures and options, allow participants to hedge or speculate on currency exchange rate movements. These are commonly used in the foreign exchange market.

Derivatives play a crucial role in financial markets, providing participants with tools to manage risk, enhance liquidity, and facilitate price discovery. However, they also carry risks, and their use requires a thorough understanding of the underlying assets and market dynamics. Derivatives markets are regulated to ensure transparency and fair practices.

Placements

Enjoy Everyday while Ensuring Great Career

Thanks to DGU’s mock interviews, value‑added courses, and hands‑on projects I developed confidence, communication skills and real-world business sense. The practical exposure and industry-aligned learning helped me step into Indigo Paints Limited ready to perform and grow.

From engaging campus activities to hands-on projects, DGU made learning practical and exciting. This experience helped me step into Reliance Retail ready to make an impact.

One thing that really helped me during the placement season was the confidence I gained from the mock sessions. My professors pointed out mistakes I hadn’t even realized I was making and gave me valuable tips that made the process smoother. This foundation prepared me well for my role at Asian Paints Ltd.

The mix of interactive learning, practical projects, and expert guidance shaped my skills effectively. It gave me the confidence to start my professional journey with Tech Mahindra.

Hands-on learning, value-added courses, and supportive faculty prepared me for real-world challenges. These experiences helped me confidently join Hafele India Pvt Ltd and contribute from day one.

DBS Global University’s rigorous learning environment and hands-on experiences challenged me to grow constantly. This preparation gave me the confidence and skills to step into Grant Thornton Bharat LLP with readiness.

DBS Global University’s competitive and dynamic environment pushed me to perform at my best every day. This energy, combined with practical learning and guidance from faculty, helped me secure my role at MyGetWellStore.

DBS Global University’s practical projects and faculty guidance helped me build real-world skills and confidence. This preparation enabled me to step into Prism Johnson ready to contribute effectively.

At DBS Global University, engaging in practical projects and hands-on learning enhanced my skills and confidence, equipping me to step into my role at Phronesis Partners with clear direction and focus.

Through DBS Global University’s hands-on projects and skill-focused sessions, I gained practical experience and strengthened my confidence. These opportunities equipped me to make meaningful contributions at Digital Marveled Private Limited.

DGU helped me grow into someone who can take on challenges with confidence and clarity. My placement at Extramarks Education feels like the right step toward building a meaningful career.

DGU shaped my skills through constant guidance, practical exposure, and a supportive environment. Getting placed at High Beam Global feels like a strong beginning to my professional journey.

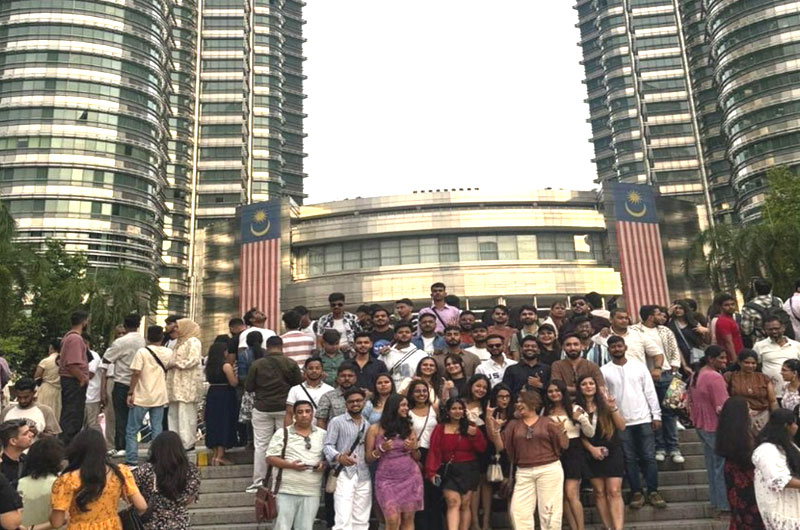

Student Education Immersion Program

Study Abroad Opportunities for Global Careers

DBS Global University offers students flexible and impactful study abroad pathways designed to build global competence and career readiness. Backed by a strong network of 50+ MOUs across 20+ countries, the University enables meaningful international exposure through Short-Term Global Immersion Programs, Credit Transfer Study Abroad Programs, and Dual Degree & Long-Term Global Pathways.

Through strategic partnerships with institutions across Australia, USA, Europe, Malaysia, Singapore, Dubai, Thailand, Indonesia, Turkey, Hong Kong and Russia, students benefit from internationally benchmarked curricula, industry exposure, multicultural classrooms, and cross-cultural learning. These experiences integrate academics with experiential learning, global networking, and real-world insights—empowering students with a global mindset, enhanced employability, and the skills required for successful international careers.